Which survey do you need?

A valuation is not a survey. Make sure you know as much as you can about the true condition of your future home before you commit to buying.

One of the first steps in the process of buying a property is arranging a survey. This will help you make a more informed decision on whether to purchase the property, what is a reasonable price, and whether you should take further advice before you commit.

While your mortgage lender will arrange a valuation, this is solely for its own benefit; the home survey is for yours. You are also under no obligation to share the results of the survey with the seller.

A RICS home survey will highlight potential problems with a property, as well as giving you an independent valuation. Getting a survey carried out can help you avoid the average £5,750 repair bill that homebuyers face once they have moved into their new home, too.

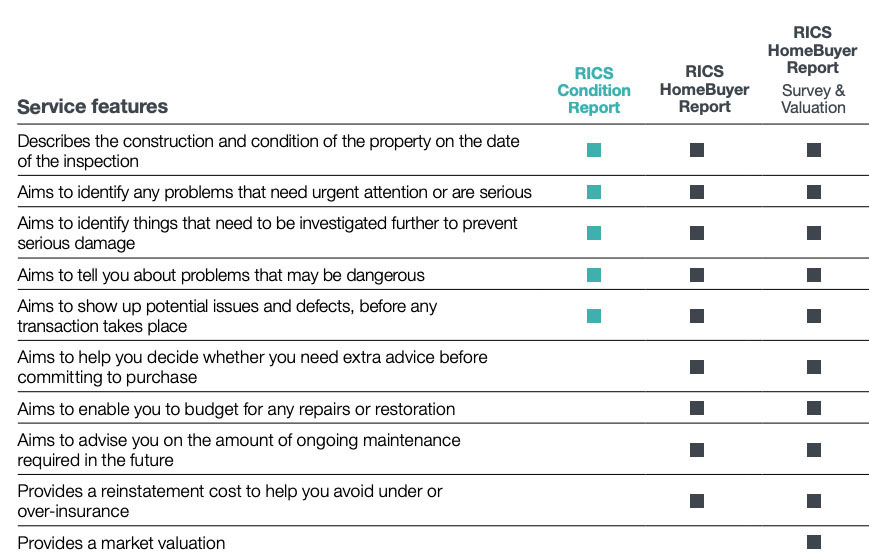

Different homes require different types of survey. Below you can find out more about what we offer.

Condition Report

This report focuses purely on the condition of your property by rating the different parts of the building and flagging up any areas that need attention. It is a matter-of-fact assessment of the condition, and does not provide any advice or a valuation.

Like the other RICS surveys, the Condition Report is based on a thorough visual inspection, but in this case, the scope is slightly reduced and information is presented without going into specific detail.

This report format is recommended when buying conventional houses, flats or bungalows constructed from common building materials, and which appear to be in reasonable condition. If you are buying a new-build property, for instance, a Condition Report will generally suffice.

Home Buyers Report

This report gives you more detailed information than the Condition Report and also provides an independent valuation of the property. It generally costs more than the Condition Report, but includes a more extensive inspection, greater detail, and the surveyor’s professional opinion on the market value of the property.

The report will also include an insurance reinstatement figure for the property, a list of problems or defects that the surveyor considers may affect the value of the property, advice on repairs and ongoing maintenance, issues that need to be investigated to prevent serious damage or dangerous conditions, legal issues that must be addressed before conveyancing is completed, and information on the location and local environment.

The HomeBuyer Report is recommended when more extensive information is needed on conventional houses, flats or bungalows constructed from common building materials, and which seem in reasonable condition. This can include homes built within the past 20 years, or older homes with a history of good upkeep.